We've recently been talking about short-run versus long-run decisions, the distinction being that in the short run firms operate at a fixed scale and firms can neither enter nor exit the industry, while in the long run these restrictions don't apply. I understand the concept, but I'm having some trouble relating it to my own business.

The textbook examples are pretty straightforward. For example, in the short run a manufacturing firm's production is limited by the capacity of its factories. In the long run it can build more factories. So far, so good. But in my business the analog to "building a new factory" is adding a server, which I can do in less then an hour. I fill out an online form, someone in our data center provisions a new machine, I get an email, run a config script, and we've expanded our capacity. In fact, I consider this to be a relatively inefficient process and look forward to the day when we move to a

more elastic infrastructure.

As for entering or leaving the industry, that happens pretty quickly too. Our entire infrastructure is leased month-to-month, so if we really had to we could wind down our business and exit the industry in a month or less. (Of course we would never do that since we have tens of thousands of customers who rely on our service, but technically we could.

Competitors have.) And other firms can

enter our industry at any time too.

So in our industry, and more broadly in the software-as-a-service (SaaS) world in general, is the short run the same as the long run, and if so what are the implications?

As I write this I realize that maybe I've simply misapplied the idea of "fixed scale" to my own business. Sure, we can add a server in no time, and that sounds like a reasonable analog to a factory for a manufacturer. But to roll out a completely new product takes a relatively long time. It requires analysis, design, implementation, and testing. That process usually takes months. And if a competitor wants to enter our industry they have to go through that same process too. Maybe a better analogy is that our software products, as opposed to our servers, that are our factories. And in that sense it takes quite a while to build a new factory.

OK, that makes sense. For us servers, unlike factories, are variable inputs. Our fixed inputs (which we happen to output for ourselves) are our software products. So the question becomes, "What happens when most of a firm's inputs are variable, and how does that affect competitiveness?" Interesting.

Greg Mankiw's students'

Greg Mankiw's students'

Well this is cool. Greg Mankiw publishes a

Well this is cool. Greg Mankiw publishes a

I just sat down to plug the important dates from both of my classes into my calendar and discovered that the first exam for both of my classes is on September 25. Boo!

I just sat down to plug the important dates from both of my classes into my calendar and discovered that the first exam for both of my classes is on September 25. Boo!

Last time I checked, I was #6 out of 9 on the waitlist for ECO 330T: Health Economics. Today I'm #2 out of 5. With a couple more add/drop days left before the semester starts, I think I have a pretty good shot at getting in. That would be awesome for a couple of reasons.

Last time I checked, I was #6 out of 9 on the waitlist for ECO 330T: Health Economics. Today I'm #2 out of 5. With a couple more add/drop days left before the semester starts, I think I have a pretty good shot at getting in. That would be awesome for a couple of reasons.

Since I'll be out of town tomorrow I've elected to take the early final exam (my first since December 1992!) today from 3p-6p.

Since I'll be out of town tomorrow I've elected to take the early final exam (my first since December 1992!) today from 3p-6p.

I got my

I got my  One of my basic questions about economics (and a

One of my basic questions about economics (and a  Sure, we'll all be holed up studying for next Friday's exam, but if anyone else wants to take a break and listen to the author of

Sure, we'll all be holed up studying for next Friday's exam, but if anyone else wants to take a break and listen to the author of  We've recently been talking about short-run versus long-run decisions, the distinction being that in the short run firms operate at a fixed scale and firms can neither enter nor exit the industry, while in the long run these restrictions don't apply. I understand the concept, but I'm having some trouble relating it to my own business.

We've recently been talking about short-run versus long-run decisions, the distinction being that in the short run firms operate at a fixed scale and firms can neither enter nor exit the industry, while in the long run these restrictions don't apply. I understand the concept, but I'm having some trouble relating it to my own business. Maybe this is obvious to everyone else but I had to look around to find it. Before you can access the restricted.utexas.edu 802.1x wireless network on campus from your iPhone, you need to

Maybe this is obvious to everyone else but I had to look around to find it. Before you can access the restricted.utexas.edu 802.1x wireless network on campus from your iPhone, you need to

Cross-posted from

Cross-posted from  I just checked my email and found several messages sent to all 300 people in my class asking for help with the homework that's due today. Actually it was due 42 minutes ago so it's too late now. Bummer.

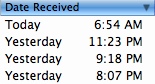

I just checked my email and found several messages sent to all 300 people in my class asking for help with the homework that's due today. Actually it was due 42 minutes ago so it's too late now. Bummer.

I've been feeling pretty good about my economics class. I've been doing the reading and taking copious notes before each class meeting, during which I annotate my notes with additional insight from the lecture. I've done the homework, the supplemental instruction exercises, and the online problems, and feel like I've mastered the material. I've been looking forward to Monday's exam with confidence. But now I'm not so sure.

I've been feeling pretty good about my economics class. I've been doing the reading and taking copious notes before each class meeting, during which I annotate my notes with additional insight from the lecture. I've done the homework, the supplemental instruction exercises, and the online problems, and feel like I've mastered the material. I've been looking forward to Monday's exam with confidence. But now I'm not so sure.